Effective for new submissions in LPA on and after October 13, 2024, Freddie Mac has implemented enhanced LPA messages for certain loans that receive a “Caution” risk class to assist lenders in identifying opportunities to turn “Caution” LPA findings into an “Accept”.

The LPA Choice feedback messages highlight opportunities to lenders in three areas:

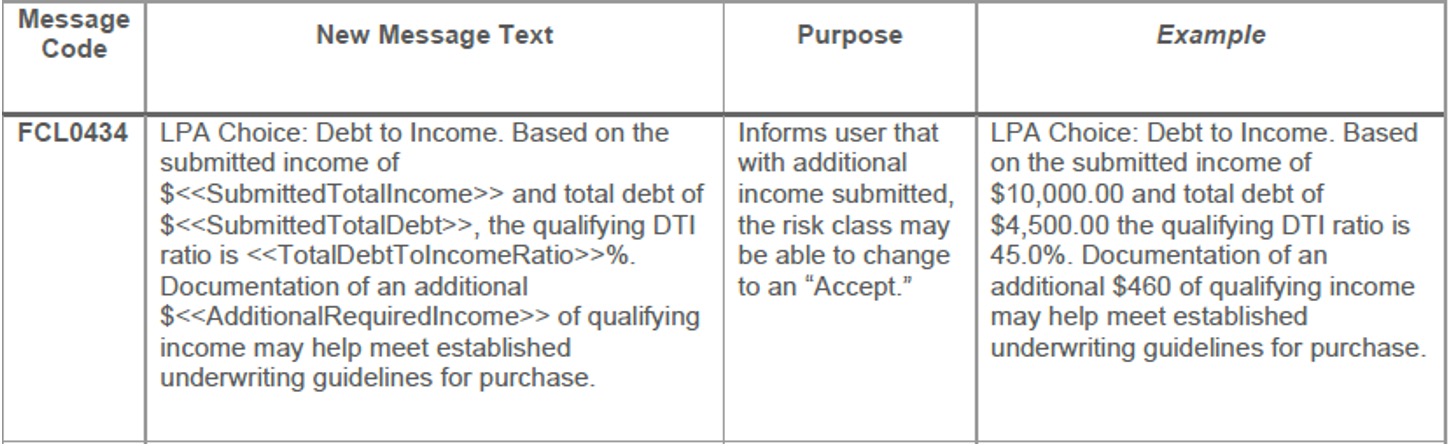

Debt-to-Income (DTI) Ratio

Example: Based on the submitted income of $10,000.00 and total debt of $4,500.00 the qualifying DTI ratio is 45.0%. Documentation of an additional $460 of qualifying income may help meet established underwriting guidelines for purchase.

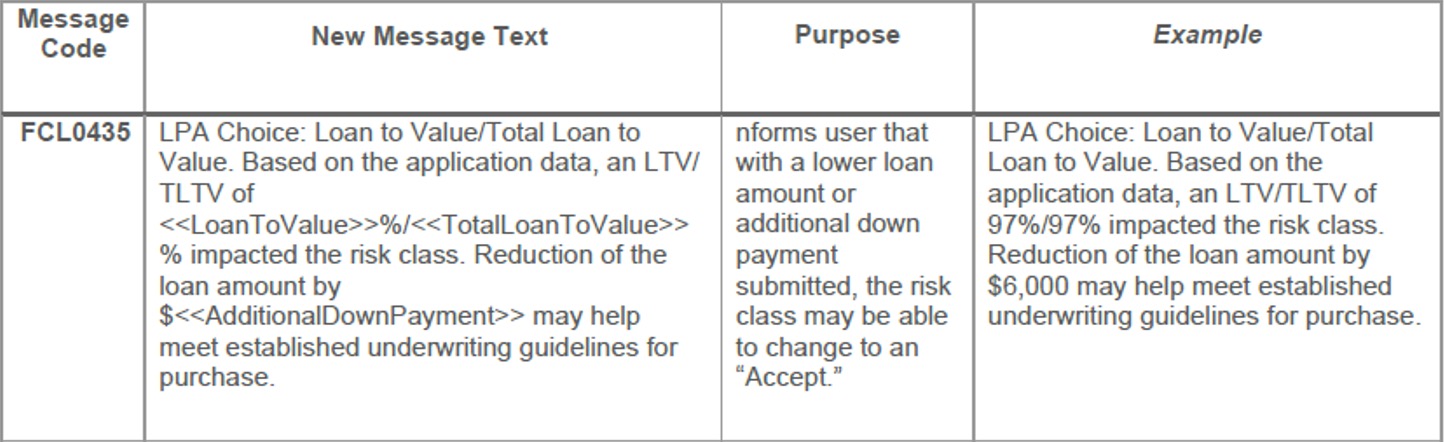

Loan-to-Value (LTV) Ratios

Example: Based on the application data, an LTV/TLTV of 97%/97% impacted the risk class. Reduction of the loan amount by $6,000 may help meet established underwriting guidelines for purchase.

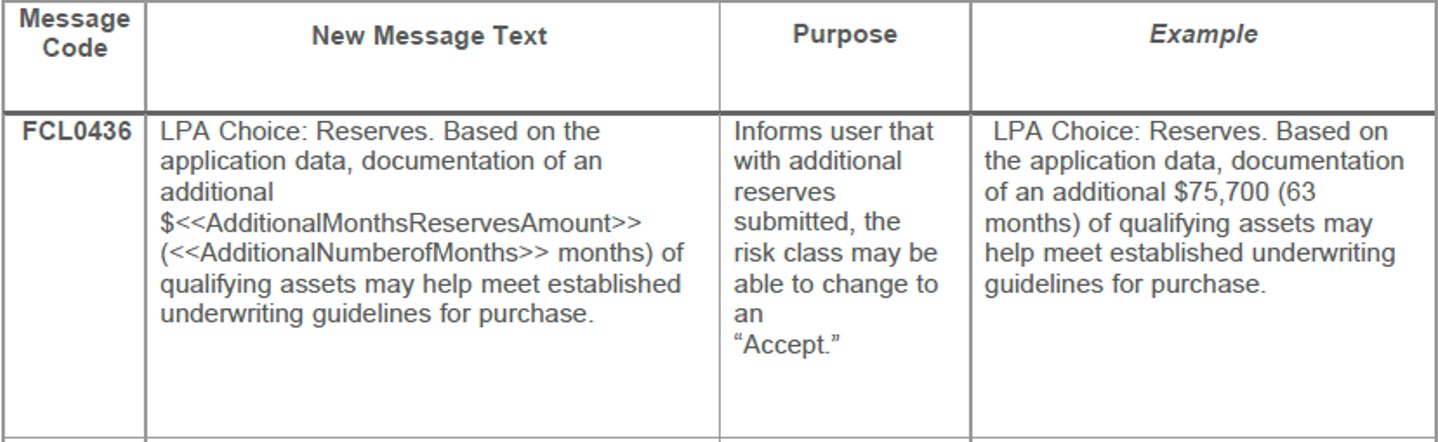

Reserves

Example: Based on the application data, documentation of an additional $75,700 (63 months) of qualifying assets may help meet established underwriting guidelines for purchase.

LPA Choice feedback messages provide valuable insights into Freddie Mac’s purchase requirements and offer actionable feedback, empowering lenders to make faster and more informed decisions.

To assist in understanding the enhanced messaging, Freddie Mac has issued a news article, LPA messaging matrix, and FAQs. Please refer to Freddie Mac for complete requirements.

Pennymac is aligning with this change.

Please contact your Sales Representative with any questions.