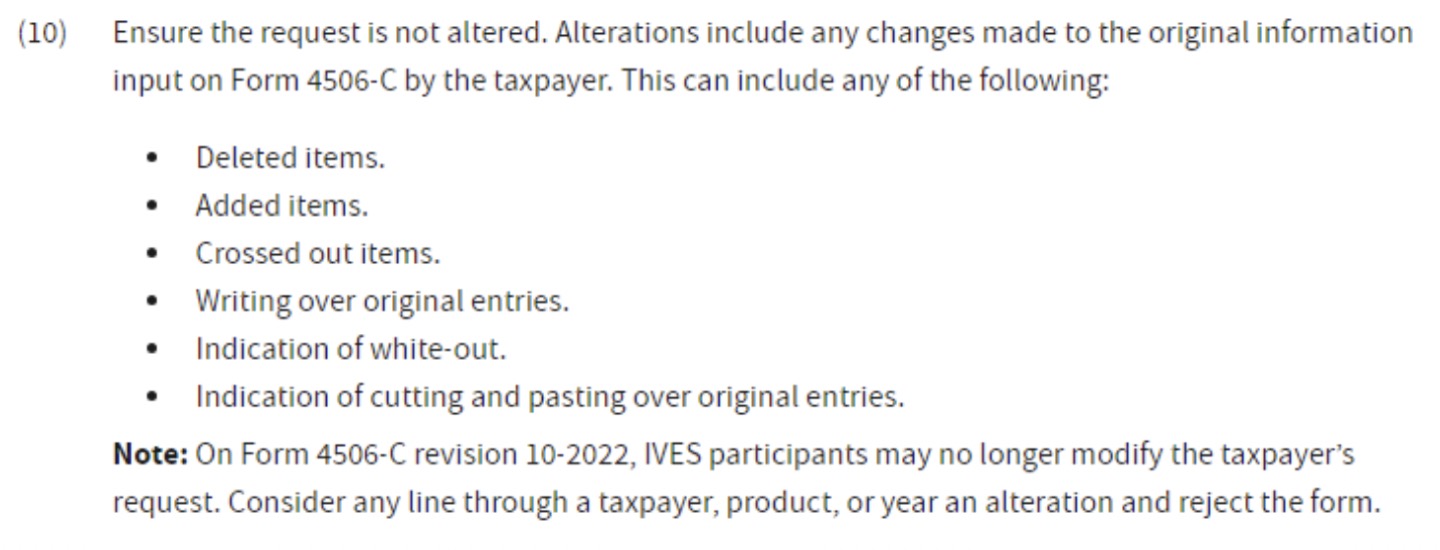

In Announcement 23-32 and Announcement 24-47, Pennymac outlined requirements surrounding inaccurate or improperly executed 4506-C forms. Pennymac is reminding clients that once the borrower has signed the form, alterations to the 4506-C are not acceptable and may result in a purchase delay and/or the loan being conditioned for a new form. An alteration is any change made to the original information input on the form by the taxpayer. Alteration examples include, but are not limited to the following:

- Electronically inserting or removing information

- Whiting-out, cutting and pasting, redacting information, checking or unchecking checkboxes

- Writing over original entries (includes crossed-out items)

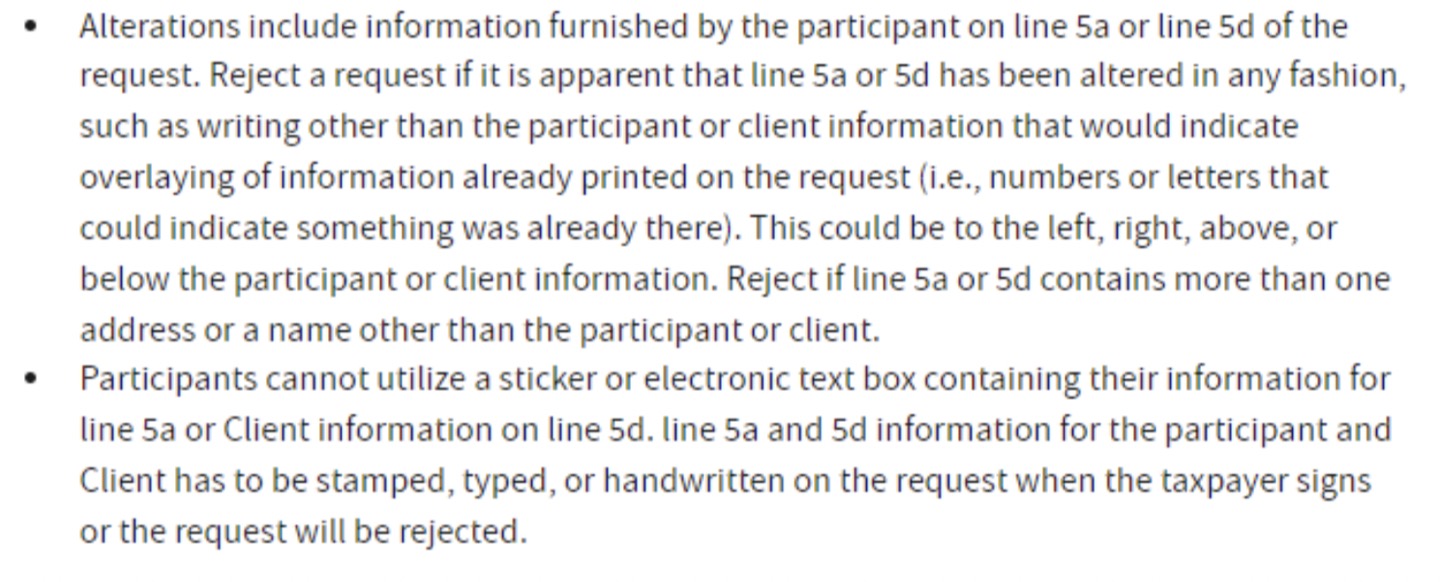

- Utilization of a sticker or electronic text box containing participant or client information

Please reference IRS IVES Section(s) 3.5.20.3.4 and 3.5.20.5.1.1(10) for IVES alteration explanations and examples.

IRS IVES 3.5.20.5.1.1(10)

IRS IVES 3.5.20.3.4

Clients should comply with the above guidance immediately.

Please contact your Sales Representative with any questions.