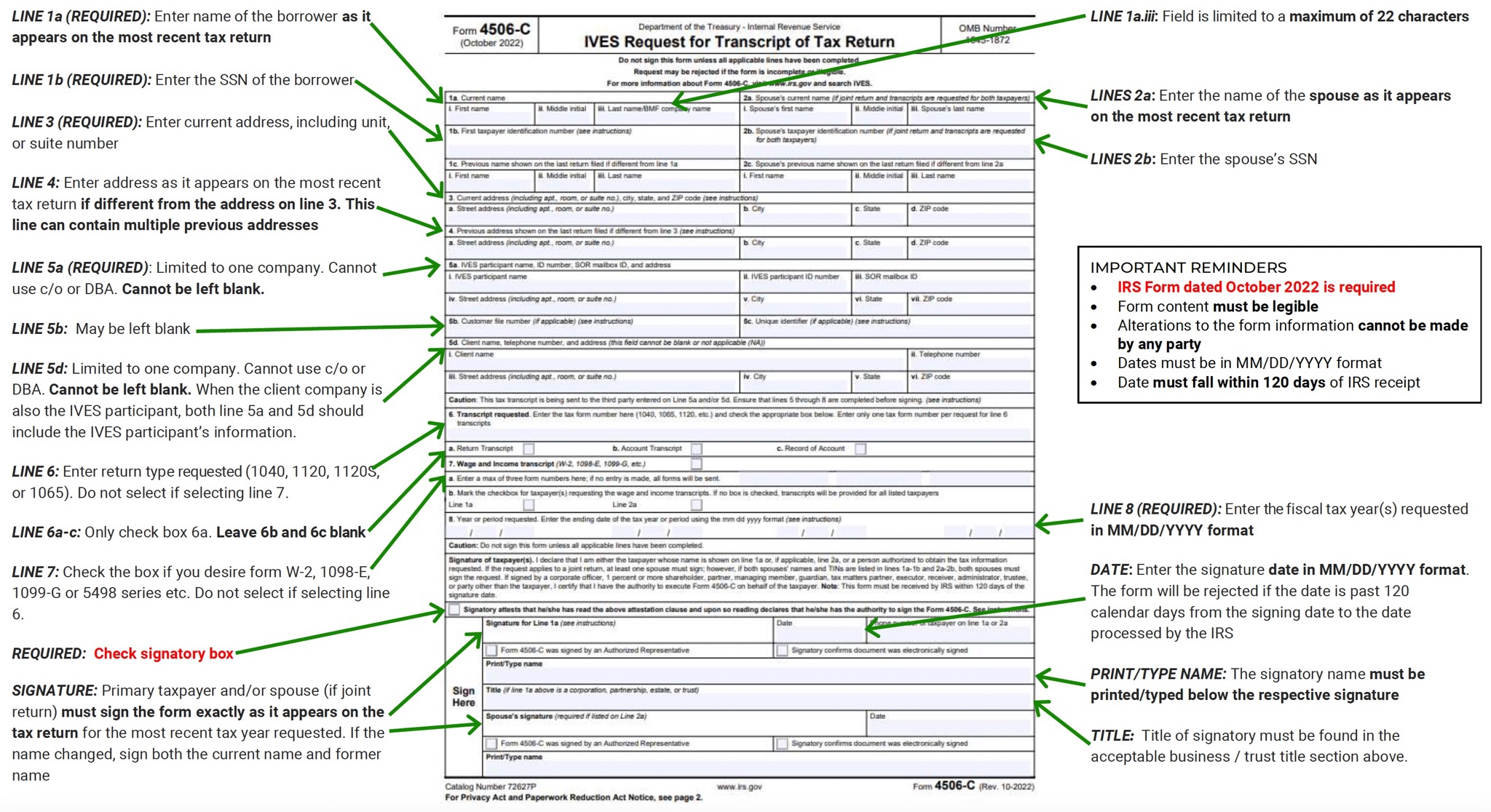

Since the implementation of the revised IRS Form 4506-C (October 22), Pennymac has experienced an increase in 4506-C IRS related defects. To assist our correspondents in navigating Form 4506-C, Pennymac has compiled a list of the most common IRS reject reasons, reject examples, acceptable business titles, along with a reference guide for successfully completing the form.

Form 4506-C | Common Reject Reasons |

|---|---|

Lines 1A-2B |

|

Line 1A.III |

|

Lines 3 & 4 |

|

Line 5d |

|

Line 6 (1040) |

|

Line 7 (1099 / W-2) |

|

Line 8 (Years) |

|

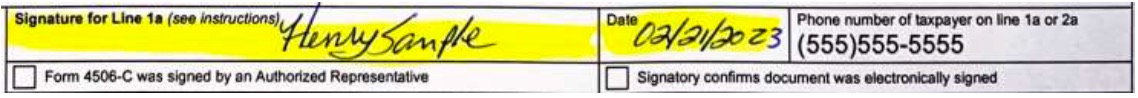

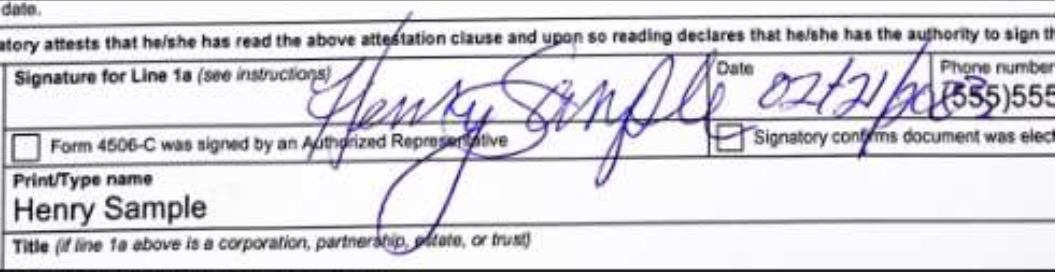

Signature |

|

E-Signatures |

|

Form |

|

Married Filing Separate |

|

Business 4506C - Acceptable Business Titles

Forms Field | Signature Requirement |

|---|---|

Form 1065, US Return of Partnership Income | One of the following

|

| Form 1120, US Corporation Income Tax Return or Form 1120S (small business), US Income Tax Return for an “S” Corporation | One of the following

|

| Form 1120 LLC, US Corporation Income Tax Return or Form 1120S LLC, US Income Tax Return for an “S” Corporation |

|

Common Reject Reason Examples

Reject Reason | Example |

|---|---|

The form was altered |  |

Fields on the form were highlighted |  |

Information spills over into a connecting field |  |

E-sign box not checked when electronically signed |  |

Not in MM/DD/YYYY Format |  |

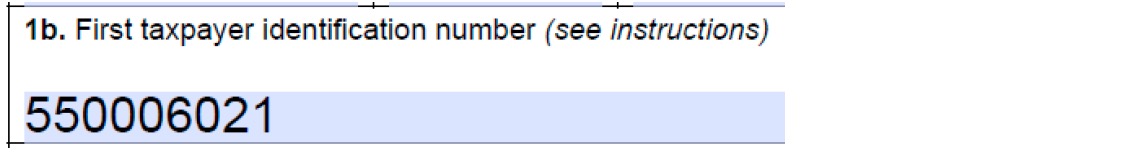

Borrower’s SSN not submitted in XXX-XX-XXXX format |  |

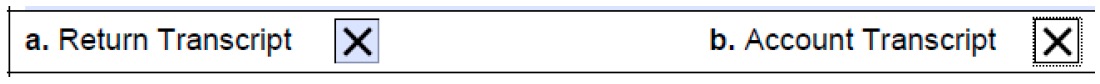

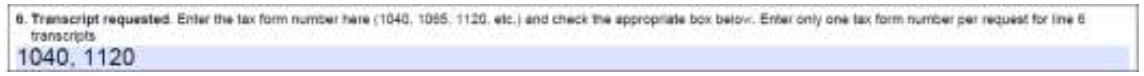

More than one checkbox was selected (6a. 6b. 6c.) |  |

More than one form type was listed |  |

Over populated form: Both lines 6 and 7 were selected |  |

Completing the 4506-C: Reference Guide

Click to Expand

Please contact your Sales Representative with any questions.