A Temporary Interest Rate Buydown, also called a “temp buydown” for short, is a financing tool that allows well qualified borrowers – who are qualified at the full note rate – to reduce their monthly payment during the early years of the mortgage. The interest rate and mortgage payments are reduced for the first couple of years as the result of a lump sum of money deposited into a buydown account.

The buydown funds are then used to reduce the borrower’s payments each month, and the borrower’s rate & payments increase annually until the full amount is reached at the end of the buydown period. The borrower may obtain the buydown funds from various sources such as the lender, property seller, or other interested parties.

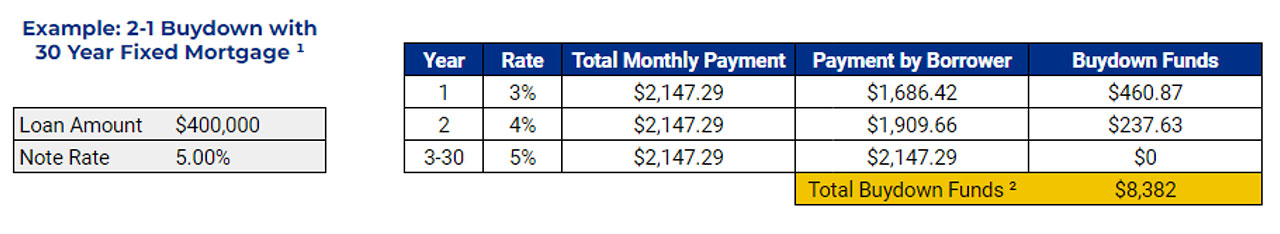

For example, in the case of a “2-1 buydown”, the borrower’s interest rate is reduced by 2% during the first year then reduced by 1% in the second year before returning to the full note rate & payment in year three.

Pennymac allows temporary buydowns for our Delegated Correspondents subject to the following.

- Max total interest rate reduction of 2%, max increase per year of 1%

- Minimum 680 FICO

- Owner Occupied / Purchase Transactions only

- Fixed rate only

- Borrower funded buydown accounts are ineligible

- See current rate sheets for applicable program LLPA

For full details, please see the following Pennymac Product Profiles.

| Fannie Mae Standard & High Balance | FHA Standard |

| [Freddie Mac Standard & Super Conforming](/assets/documents/products/freddie-mac-standard-and-super-conforming-balance-product-profile.pdf | |

| ){: target=”_blank”} | VA Standard |

| Fannie Mae HomeReady | USDA/Rural Standard |

| Freddie Mac Home Possible |

Please contact your Sales Representative with any questions.

1 This example is provided for illustration purposes only. Actual rate and/or terms may differ. This is not an offer for extension of credit or a commitment to lend or to purchase loans.

2 Total Buydown Funds = Year 1 ($460.87 x 12 months = $5,530.44) + Year 2 ($237.63 x 12 months = $2851.56) = $8,382