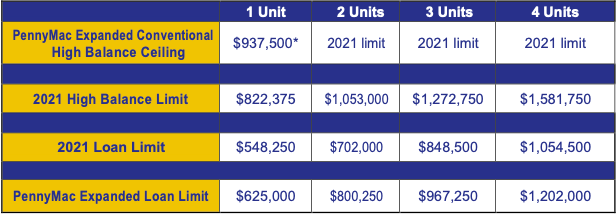

On September 22nd, we announced expanded conventional loan limits to at least $625,000 for all states and counties. (See Announcement 21-73)

Today we are excited to announce expanded conventional high balance limits effective for delegated and non-delegated Best Efforts locks as of Monday October 11, 2021. For select high cost area counties, we are offering increased conventional high balance limits up to $937,500 on one unit properties only.

Please use the lookup tool for PennyMac’s expanded county limits.

* Not all counties are increasing to $937,500 see county list for new limits applicable to each county.

We want to remind you that:

- DU and LPA will return an ineligible result. PennyMac will accept Approve/Ineligible (DU) and Accept Ineligible (LPA) due only to the loan amount in excess of the 2021 limits.

- A full appraisal is required for the expanded loan limits. Appraisal waivers are not allowed with an ineligible decision. In areas where the PennyMac loan limits are within the current 2021 high cost limits, appraisal waivers remain eligible.

- At this time, loan amounts in excess of $625,000 that are also in excess of the 2021 high cost limits are subject to an LTV Max of 80%. If the loan amount is supported by existing FHFA 2021 loan limits then this LTV Max does not apply. For your convenience, we have highlighted loan amounts for those counties subject to this overlay on our attached look-up tool.

- PennyMac’s expanded loan limits may not be supported by all pricing engines. Please price your scenarios through our P3 Portal if you are not seeing these options within your pricing engine.

- For clients utilizing our batch BE locking feature, please note that loans over the expanded loan limits outlined here will return a price even though they are not eligible for delivery. For your protection, it is recommended that these loans price individually through the P3 Portal.

- Loans exceeding the 2021 loan limits may be subject to additional diligence reviews.

Should you have any questions or if you are interested in locking these loans in bulk, please contact your account executive.