Effective immediately, PennyMac is supporting our Correspondents by offering conforming high balance loan amounts up to at least $625,000 in all States and Counties.

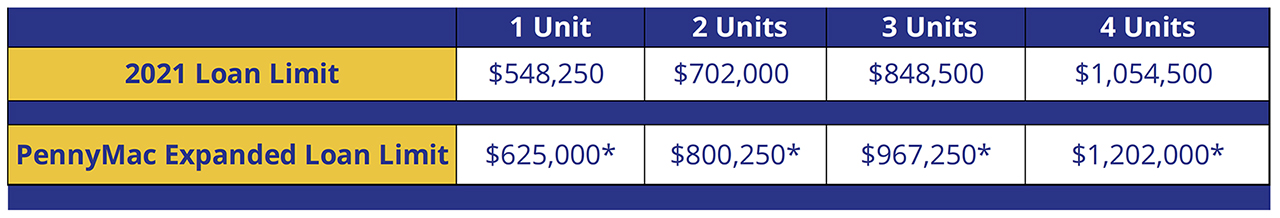

Counties with high cost limits for 2021 that are already greater than $625,000 are not changing. PennyMac is also increasing the conforming loan limit for 2-4 units as shown on the below table:

*See attached spreadsheet for Alaska and Hawaii as PennyMac’s newly expanded loan limits are higher for these states.

Notes:

- DU and LPA will return an ineligible result. PennyMac will accept Approve/Ineligible (DU) and Accept/Ineligible (LPA) due only to the loan amount in excess of the 2021 loan limits.

- A full appraisal is required for the expanded loan limits. Appraisal waivers are not allowed with an ineligible decision. In areas where the PennyMac loan limits are within the current 2021 high cost limits, appraisal waivers remain eligible.

- Loans in excess of current 2021 County loan limits, and up to PennyMac expanded loan limits, will be eligible and priced as conforming high balance.

- PennyMac expanded loan limits will NOT be supported by pricing engines. Please price your scenarios through the P3 Portal for accurate pricing.

- For clients utilizing our batch BE locking feature, please note that loans over the expanded loan limits outlined here will return a price even though they are not eligible for delivery. For your protection, it is recommended that these loans price individually through the P3 Portal.

PennyMac recommends that Correspondents confirm eligibility with their warehouse banks and mortgage insurance partners as early as possible to address any unforeseen issues.

Please contact your Sales Representative with any question