09/16/2024

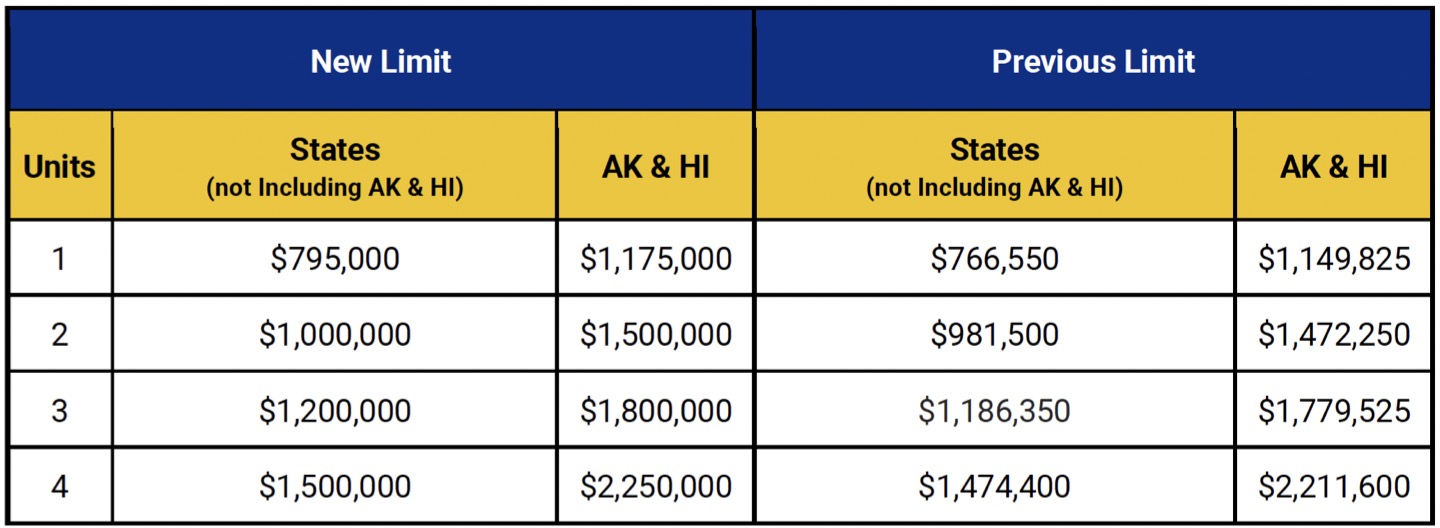

Pennymac Correspondent is excited to announce that we’re raising our Conventional loan limits to $795,0001 for all commitment types, effective 09/17/2024.

Details:

- Increased loan limits are effective for new locks starting on 09/17/2024 for Conventional loans only. Government loan limits remain unchanged.

- Loans with a DU Approve/Eligible will continue to be eligible for Value Acceptance and Value Acceptance + PDC. Loans with an LPA Accept/Eligible will continue to be eligible for ACE and ACE + PDR.

- Loans with an AUS Approve/Ineligible or Accept/Ineligible (ineligible for loan limits only) are eligible for delivery and will require a full appraisal.

- Seller may be responsible for rerunning the AUS (and providing to Pennymac) within one week of the official update to the new loan limits.

- We expect the official loan limits to be release and AUSs updated by early to mid-December.

- As a reminder, credit reports cannot be older than 120 days at the time of the AUS rerun.

- Loans not receiving an Approve/Eligible or Accept/Eligible finding on the rerun of the AUS may be subject to repurchase unless the sole reason for the ineligible finding is due to a discrepancy between Pennymac’s new loan limits and the final conventional loan limits.

1Official 2025 conventional loan limit changes will be determined by an upcoming FHFA announcement.

Pennymac recommends that Sellers confirm eligibility with their warehouse banks and mortgage insurance partners as early as possible to address any unforeseen issues.

Pennymac will update Conventional LLPAs effective for all Best Effort commitments taken on or after 09/17/2024 as follows:

- Add new ‘Loan Balance Adjustments’ Grid

Please contact your Sales Representative with any questions.