03/04/2024

FHA requires the debt of a non-borrowing spouse (NBS) to be included on the URLA and included in the qualifying debt ratios if:

- The NBS currently resides in a community property state; or

- The property being purchased is located in a community property state.

Pennymac confirmed the above with FHA and have updated our guidelines accordingly. Please refer to the examples below for guidance.

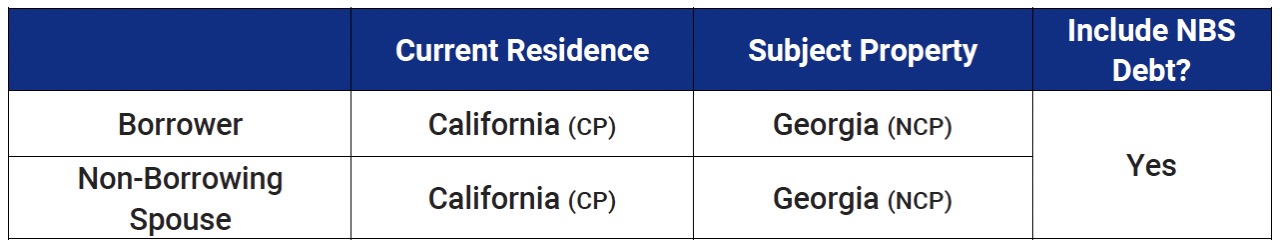

Example 1:

- The NBS resides in California at the time of application, which is a community property state, and the new primary residence (subject property) is in Georgia, which is not a community property state.

- The NBS’s debt must be included in the qualifying ratios

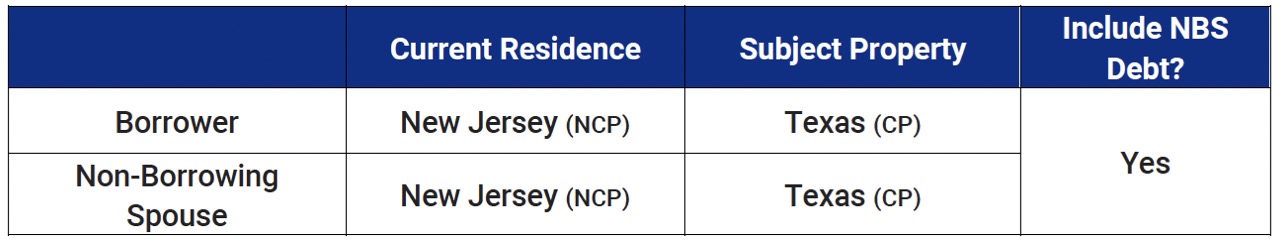

Example 2:

- The NBS resides in New Jersey at the time of application, which is a non-community property state, and the new primary residence (subject property) is in Texas, which is a community property state.

- The NBS’s debt must be included in the qualifying ratios

Please contact your Sales Representative with any questions.