11/13/2024

Pennymac would like to remind lenders of the requirements for properties located within a Coastal Barrier Resource System (CBRS) or Otherwise Protected Areas (OPA).

Identifying CBRS or OPA

- Lenders are expected to have processes in place to identify and report when a property is located within a CBRS or OPA and to comply with the respective requirements.

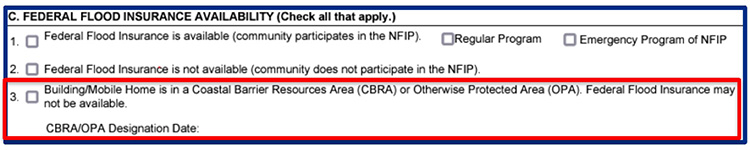

- The FEMA Standard Flood Hazard Determination Form (SFHDF) identifies if a property is located within a CBRS or OPA. Note: the FEMA form uses the term CBRA instead of CBRS.

- Per Pennymac requirements, the appraiser is also expected to report adverse site conditions, zoning, and additional information within the report to assist in identifying a property is located within a CBRS or OPA.

Fannie Mae:

- Flood insurance is mandatory for all loans secured by properties in a CBRS or OPA, regardless of the Special Flood Hazard Area (SFHA) determination. This policy can be obtained from the National Flood Insurance Program (NFIP) or a private insurer.

- If the property is in a CBRS or OPA and the community does not participate in the NFIP, the loan is only eligible if the property is not in an SFHA.

- Fannie Mae special feature code delivery requirements apply.

Pennymac AUS Jumbo: Properties located in a CBRS or OPA are ineligible for financing.

Refer to Fannie Mae Selling Guide for complete requirements.

Please contact your Sales Representative with any questions.