Pennymac is aligning with the Automated Collateral Evaluation (ACE) Waiver Eligibility Updates and the new offering, ACE+ PDR (property data report) originally announced in Freddie Mac Bulletin 2022-6 and then superseded by Freddie Mac Bulletin 2022-13.

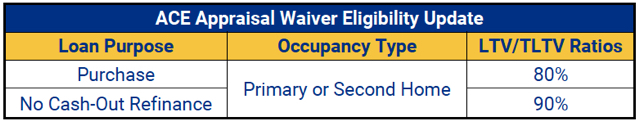

ACE Appraisal Waiver Eligibility Update

Effective 7/17/2022, Freddie Mac cash-out refinances and certain “no cash-out” refinance transactions will no longer be eligible for ACE appraisal waivers. The below table reflects the updated requirements for ACE appraisal waivers.

ACE+ PDR

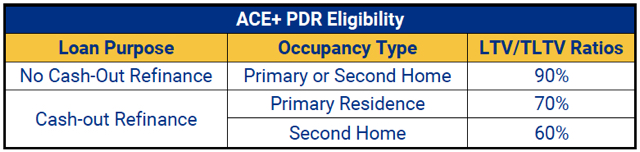

Effective for new LPA submissions on or after 7/17/2022, Freddie Mac is offering, ACE+ PDR which will allow cash-out refinances and certain “no-cash-out” refinance transactions without an appraisal.

With ACE+ PDR, additional property information is collected on-site by trained data collectors using the proprietary Freddie Mac PDR dataset, in lieu of a traditional appraisal.

Eligibility

- For a loan to be eligible for the ACE+ PDR option in lieu of an appraisal, The LPA submission request must receive a risk class of Accept and

- The last LPA feedback certificate must indicate the loan is eligible for a PDR.

- The following requirements must also be met to receive an ACE+ PDR offer:

- Loan must be secured by a 1-unit Primary residence or second home, including units in a condominium project.

- The loan must be a “no cash-out” or a cash-out refinance transaction

- The loan must meet the maximum LTV/TLTV ratio requirements in the below table:

ACE+ PDR Upgrade Requirements

In certain situations, the review of the PDR may indicate that the subject property has characteristics or conditions that require an upgrade to an appraisal.

For single-family homes, in lieu of upgrading to an appraisal on Form 70, Uniform Residential Appraisal Report, Freddie Mac will accept a hybrid appraisal reported on new Form 70H, Uniform Residential Appraisal Report(Hybrid).

Please see Freddie Mac Bulletin 2022-13 for additional details and requirements.

Please contact your Sales Representative with any questions.