Handbook Updates

VA has recently released updates to several chapters of the VA Lender’s Handbook. Effective dates for each chapter can be found in VA Transmittal summaries numbers 23 through 30 on VA’s website at https://www.benefits.va.gov/WARMS/pam26_7.asp.

Due to the extensive nature of the changes, PennyMac recommends Lenders review all updated chapters for complete details on the changes.

Unless otherwise announced, PennyMac will be aligning with all updates to the VA handbook, while maintaining current overlays.

VA Chapter 4 Updates

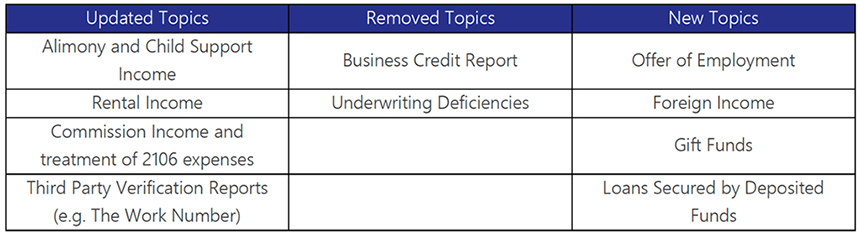

For all VA transactions with applications on or after May 23, 2019, PennyMac will be aligning with the updates made by VA to Chapter 4. Chapter 4 has been updated with previously published circulars and new updates. Updates to the handbook associated with circulars retain the effective date of the applicable circular, while all other updates are effective May 23, 2019. Updates include but are not limited to the following:

Note that while PennyMac is aligning with VA’s updates, existing overlays are being retained.

Circular 26-19-09

Previously, when a borrower earned 25% or more in commission income, 2106 expenses were deducted from qualifying income.

Previously, when a borrower earned 25% or more in commission income, 2106 expenses were deducted from qualifying income. Effective immediately, for all VA full doc transactions, as a result of the tax law changes, the different treatment of commission income based on the percentage of qualifying income is being removed. In addition, Lenders no longer need to provide form 2106 with 2018 tax returns.

Please contact your Sales Representative with any questions.