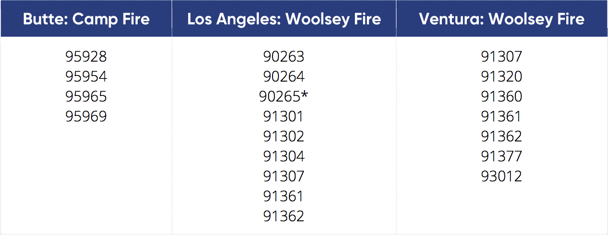

FEMA has recently declared Butte, Los Angeles, and Ventura counties in California as eligible for Individual Assistance due to the Camp Fire and Woolsey Fire. In accordance with PennyMac’s existing Disaster Policy, PennyMac will be requiring post-disaster inspections for the following zip codes. Please see loan level stips for effective date of the required re-inspection. As a reminder, FHA loans require a post-disaster inspection after the FEMA declared end date in order to be eligible for FHA insurance.

*Fundings in these zip codes are still paused due to ongoing evacuations.

FEMA and PennyMac are continuing to evaluate the extent of the damage and may add or remove additional locations at a later date. The incident has an effective date of November 8, 2018 and ongoing.

Existing PennyMac Disaster Policy

If the subject property is located in one of the impacted counties and the appraisal was completed prior to the incident period end date, PennyMac will require a post disaster inspection confirming the property was not adversely affected by the disaster. Clients may utilize any of the following re-inspection options to satisfy the post disaster inspection requirement:

- Property Inspection Report (Form 2075), or

- Appraisal Update and/or Completion Report (Form 1004D), or

- Certification from a Licensed Property Inspector, or

- (Delegated only option) Lender Certification with post-disaster photos that clearly demonstrate the property has not been adversely affected by the disaster. The Certification must not be executed by an employee that receives direct compensation from the subject transaction.

Note: Loans without an appraisal, such as DU Refi Plus, LP Open Access, and FHA Streamline, will require an eligible inspection product for a period of 90 days from the incident period end date, based upon the note date.

For complete details, please refer to the PennyMac Disaster Policy located in the PennyMac Seller’s Guide on www.gopennymac.com. Please contact your Sales Representative with any questions.